Despite the negative impact of the global stock market plunge this morning, the VN-Index still managed to reverse the trend and close the session with an increase.

In the face of the violent shaking of global stocks when the US and Asian markets simultaneously turned red due to investors rushing to sell off, in the trading session this morning, March 11, the VN-Index at one point lost nearly 15 points. The HoSE floor at one point recorded the number of stocks decreasing by approximately 360 codes, 6 times more than the number of stocks increasing.

However, the cash flow took advantage of the strong fluctuations to disburse, causing the market to gradually return to a state of balance.

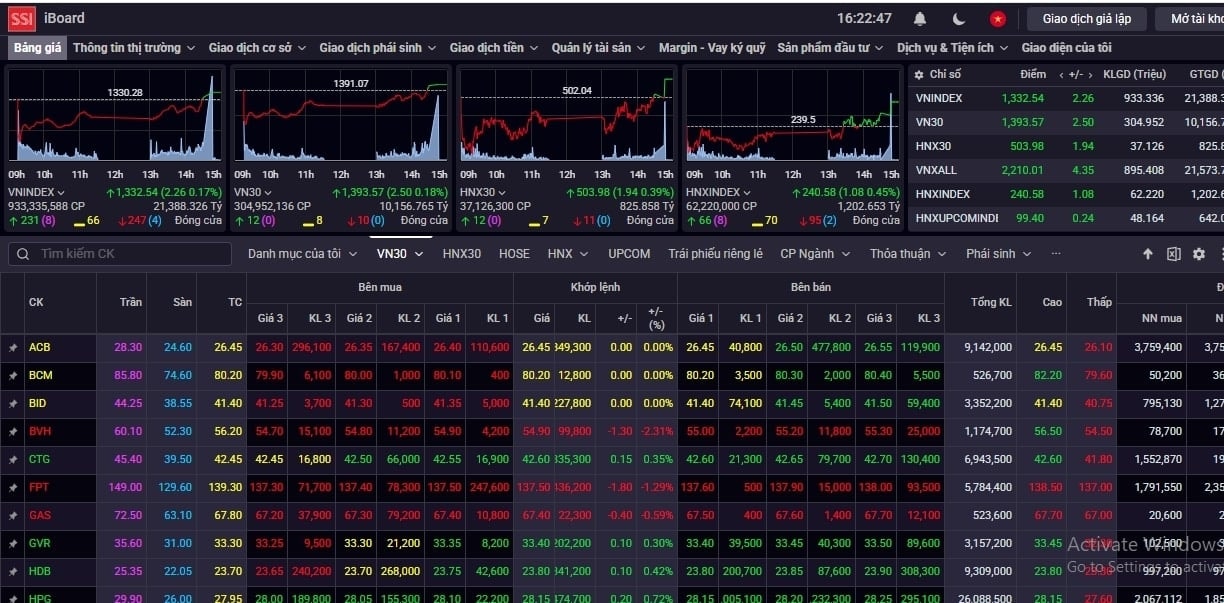

Strong demand in the last minutes of the session helped VN-Index regain green and close at 1,332.5 points, up 2.26 points (equivalent to +0.17%) compared to the reference. This is the fourth consecutive increase. On the HoSE floor, there were 231 stocks increasing and 247 stocks decreasing. The total trading volume reached more than 933.3 million units, worth VND21,388.3 billion.

Although the increase was very small, it was a very impressive result in the context of global stocks being engulfed in a "sea of fire". In particular, if looking at the developments during the session, the "escape" level at the end of the session was even more impressive.

In the VN30 group, if at the end of the morning session there were 26 stocks decreasing, then at the end of the session there were only 10 stocks decreasing and the decrease was also at a low level. Of which, BVH led the way, decreasing by only more than 2% to 54,900 VND, FPT lost 1.3%, and the codes VRE, SAB, LPB, GAS, VIB decreased insignificantly.

On the other hand, many stocks reversed and increased, helping the VN-Index increase again. MBB, MWG and VPB increased by more than 1%.

On the HNX floor, the HNX-Index also reversed dramatically, increasing by 1.07 points (0.45%) to 240.58 points thanks to more positive demand in the last minutes. The total matched volume reached more than 55.4 million units, worth VND1,088.6 billion.

Similarly, UpCoM-Index surpassed the reference in the last minutes of the session. At the end of the session, UpCoM-Index increased by 0.23 points (+0.24%), to 99.4 points. The total matched volume reached more than 47.5 million units, worth 634.7 billion VND.

Early this morning, US stocks were in the red amid investors' concerns that Donald Trump's tariff policy would push the US economy into recession. According toCNBC, in the trading session on March 10 (local time), US stocks continued to witness a three-week sell-off as investors worried that uncertainty over tariff policies could push the economy into recession. Last weekend, US President Donald Trump did not deny this possibility in an interview.

Specifically, the S&P 500 index fell 2.7%, at one point hitting its lowest level since September last year and closing at 5,614.56 points. The Nasdaq Composite index saw the sharpest decline among the major indexes, plunging 4%, marking its worst trading session since September 2022 and ending at 17,468.32 points.

Meanwhile, the Dow Jones index fell 890.01 points, or 2.08%, to close at 41,911.71.

Notably, stocks in the “Magnificent Seven,” once the main drivers of the stock market, led the decline as investors sold off in search of safer assets. The group includes the world’s seven largest and most influential technology companies: Apple, Microsoft, Amazon, Alphabet (Google’s parent company), Meta (formerly Facebook), Nvidia and Tesla.

Tesla shares plunged 15%, their worst day since 2020. Alphabet (Google) and Meta (Facebook) fell more than 4%. Nvidia, considered a "star" in the artificial intelligence race, fell 5%. Palantir, one of the stocks favored by individual investors, also fell 10%.

Signs of investors pulling back from risk were everywhere on Wall Street. The CBOE Volatility Index (VIX), the best gauge of fear on Wall Street, rose to its highest level since December. Bitcoin fell below $80,000 and U.S. Treasury yields fell.

TH (according to VTC News)